In these cases, it is important to evaluate other factors, such as revenue growth and market potential, to determine the company’s potential for long-term success.

#FREE CASH FLOW FORMULA FINANCE FREE#

Some industries, such as tech startups, may have negative free cash flow for years as they invest heavily in growth and innovation. When interpreting free cash flow, it is important to consider the company’s industry and stage of growth. This could indicate that the company is investing heavily in growth or that it is facing financial difficulties. It reflects that the company has cash available to pay dividends, pay down debt, or invest in the business.Ī negative free cash flow, on the other hand, means that the company is spending more on capital expenditures than it is generating cash from operations. A positive free cash flow indicates that a company has generated more cash from its operations than it has spent on capital expenditures.

#FREE CASH FLOW FORMULA FINANCE HOW TO#

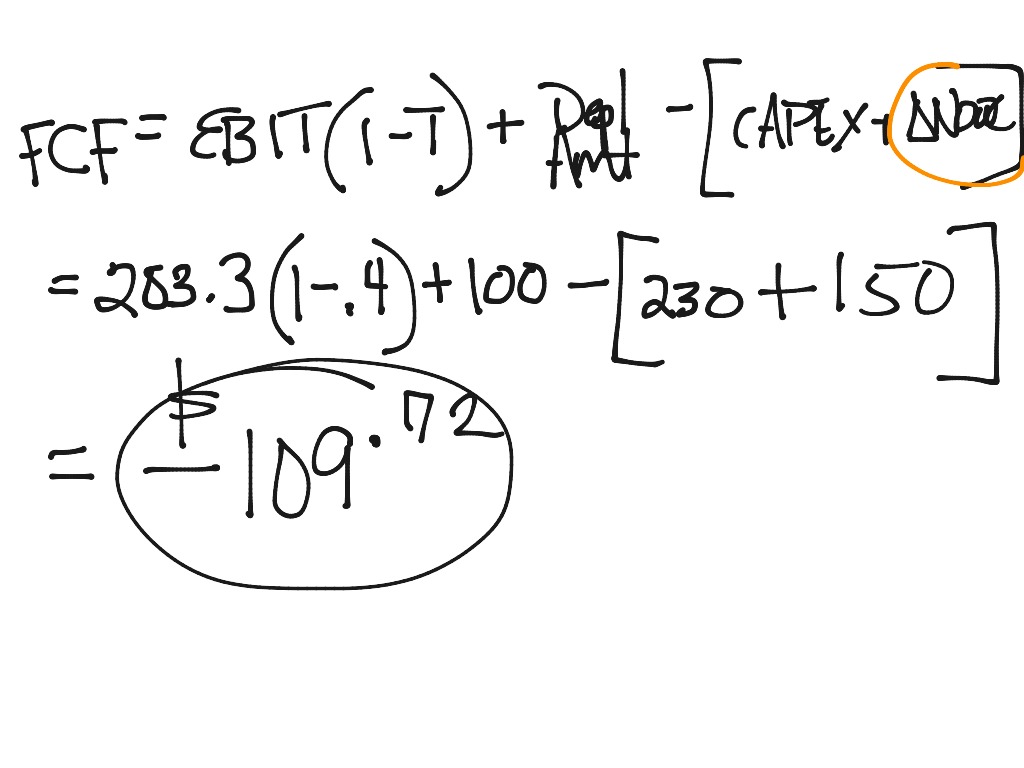

Now that you know how to calculate free cash flow, let’s understand how to interpret it. Using the formula, we can calculate the free cash flow for Company XYZ as follows:įree Cash Flow = Rs 40,000 Interpreting Free Cash Flow Suppose you are analyzing Company ABC’s financial statements for the year 2022. Let’s look at an example of how to calculate free cash flow. The resulting number is the free cash flow for the period under consideration. Subtract capital expenditures from operating cash flow. Finally, use the formula to calculate free cash flow. Next, find the capital expenditures (CAPEX) for the same period. Start by finding the operating cash flow (OCF) for the period under consideration.

You can find the information you need in the company’s statement of cash flows and its balance sheet. To calculate free cash flow, you will need to gather information from a company’s financial statements. This can include investments in new facilities or upgrades to existing facilities. It includes cash from the sale of goods or services, less cash paid out for operating expenses such as rent, salaries and utilities.Ĭapital expenditures (CAPEX) are the investments made by a company in long-term assets like plant & machinery, property and equipment, among others.

Operating Cash Flow (OCF) is the cash that a company generates from its daily operations. The free cash flow formula is:įree Cash Flow = Operating Cash Flow - Capital Expenditures The formula to calculate free cash flow is relatively straightforward. It represents the amount of cash that a company has available for distribution to shareholders, for reinvesting in the business or for paying down debt.įree cash flow is an essential metric for investors as it shows the efficiency of a company to generate cash and the money it has available to reward its shareholders. What is Free Cash Flow?įree cash flow (FCF) is the cash generated by a company from its operations after deducting the capital expenditures required for its operations. In this article, we will explore what is free cash flow, its formula and how to calculate free cash flow. Free cash flow (FCF) is a specific type of cash flow that measures the amount of cash a company generates after accounting for capital expenditures and other investments.

It represents the amount of cash that flows into and out of a business, and it is essential for the day-to-day operations and long-term growth of the business. Cash flow is a metric used to measure a company’s ability to generate cash from its business.

0 kommentar(er)

0 kommentar(er)